Overview

What is LOVAT?

Tax software for VAT/sales tax filing. LOVAT platform collects all tax data across any sales channel and files VAT returns in a minute. Accurate VAT calculation, tax due reminders, automatic filing, free data storing with the real-time support of tax…

Learn from top reviewers

Commonly Discussed Topics

Pricing

Start-Up

40/month

Standard

80/month

Premium

500/month

Entry-level set up fee?

- No setup fee

Offerings

- Free Trial

- Free/Freemium Version

- Premium Consulting/Integration Services

Features

Product Details

- About

- Integrations

- Competitors

- Tech Details

- FAQs

What is LOVAT?

Tax software for VAT/sales tax filing.

LOVAT platform collects all tax data across any sales channel and files VAT returns in a minute.

Accurate VAT calculation, tax due reminders, automatic filing, free data storing with the real-time support of tax expert team available.

LOVAT enables the user to register a business for VAT and sales tax purposes in foreign countries where it stores goods or where it is selling products or services.

LOVAT specializes in helping companies to achieve compliance with EPR regulations.

LOVAT Features

Type of tax Features

- Supported: Sales and Use Taxes

- Supported: VAT / GST Taxes

Tax Reporting & Compliance Features

- Supported: Geolocation for Tax Assessment

- Supported: Tax Data Reporting

- Supported: Compliance Administration Management

- Supported: Tax Document Management

Additional Features

- Supported: Extended Producer Responsibility (EPR) registration and reporting

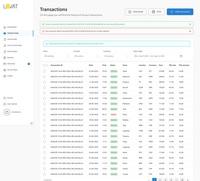

LOVAT Screenshots

LOVAT Video

LOVAT Integrations

LOVAT Technical Details

| Deployment Types | Software as a Service (SaaS), Cloud, or Web-Based |

|---|---|

| Operating Systems | Unspecified |

| Mobile Application | No |

| Supported Countries | Europe, Australia, Canada, USA |

| Supported Languages | English, Spanish, Chinese, German |