Overview

What is Airbase?

Airbase headquartered in San Francisco offers a cloud-based accounts payable and spend management solution, and combines a pre-approval system with corporate cards, allowing users to manage the entire AP spend process in one place.

How Airbase Differs From Its Competitors

Awards

Products that are considered exceptional by their customers based on a variety of criteria win TrustRadius awards. Learn more about the types of TrustRadius awards to make the best purchase decision. More about TrustRadius Awards

Popular Features

- Customizable Approval Policies (17)9.090%

- Payment Status Tracking (17)8.787%

- Payment Audit Trail (16)8.686%

- Financial Document Management (16)8.181%

Reviewer Pros & Cons

Pricing

Entry-level set up fee?

- No setup fee

Offerings

- Free Trial

- Free/Freemium Version

- Premium Consulting/Integration Services

Would you like us to let the vendor know that you want pricing?

29 people also want pricing

Alternatives Pricing

Features

Product Details

- About

- Integrations

- Competitors

- Tech Details

- FAQs

What is Airbase?

Airbase is a procure-to-pay solution that blends enterprise capabilities with a simplified user experience.

Key Benefits.

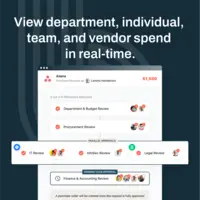

With Airbase, mid-market to early-enterprise level companies streamline complex approval and accounting processes for all non-payroll spend while ensuring employee adoption across the entire organization.

Workflow management.

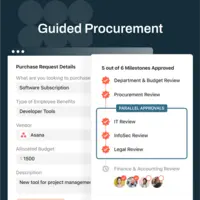

Navigable complex approval and accounting workflows with configurable, no-code workflows.

Time and cost savings.

Eliminates unnecessary spending, saving time and resources, and reducing the time to close.

Comprehensive product suite.

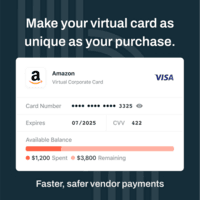

Any or all products can be integrated—Guided Procurement, AP Automation, Expense Management, and Corporate Cards—to meet current demands and future scalability.

Compliance and collaboration.

Integrations with adjacent business systems directly or via an open API mean all stakeholders can work with their existing tools.

Airbase Features

Accounts Payable Features

- Supported: Automated Accounts Payable Processes

- Supported: Vendor Management

Payment Management Features

- Supported: Customizable Approval Policies

- Supported: Financial Document Management

- Supported: Payment Status Tracking

- Supported: Payment Audit Trail

- Supported: Duplicate Bill Detection

- Supported: Advanced OCR

- Supported: Electronic Funds Transfer

- Supported: PCI Compliant Security Measures

Airbase Screenshots

Airbase Integrations

Airbase Competitors

Airbase Technical Details

| Deployment Types | Software as a Service (SaaS), Cloud, or Web-Based |

|---|---|

| Operating Systems | Unspecified |

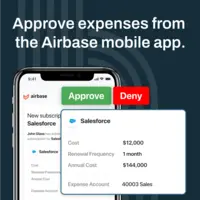

| Mobile Application | Apple iOS, Android |

| Supported Countries | United States |

| Supported Languages | English |