Collaboration Software Statistics and Trends

Human connection is more important than ever as the world battles COVID-19. The internet has played a pivotal role in disseminating information and sharing experiences—especially in the United States, where the pandemic has contributed to increased economic and racial inequality. Businesses and individuals alike are using new software tools to foster connections during these uncertain times.

One of the software categories benefiting from these changing cultural and workplace dynamics is collaboration software. This category includes applications that facilitate online communication and productivity, often pairing video conferencing and chat with advanced file-sharing capabilities.

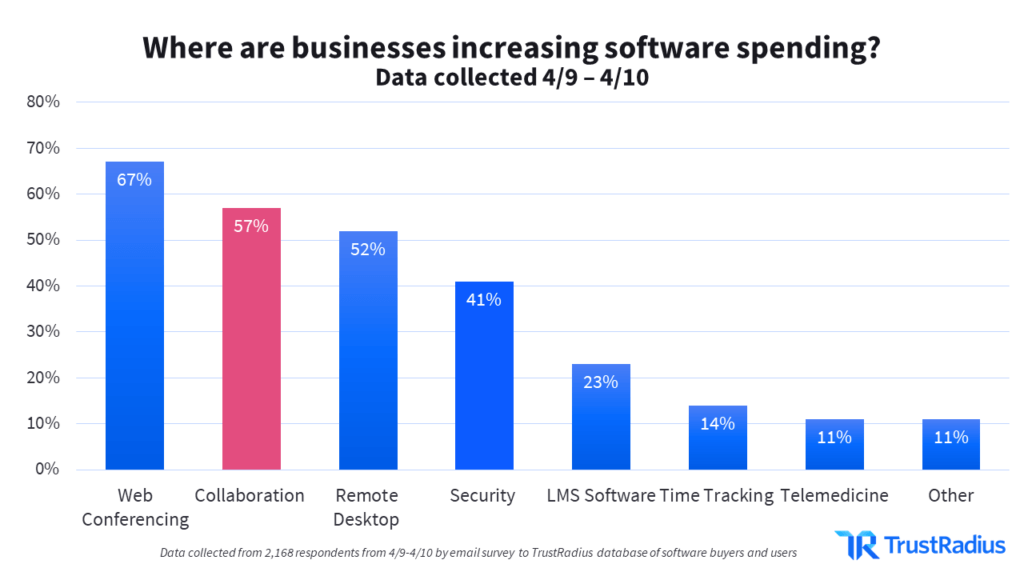

On Trustradius, we’ve seen a 400% increase in traffic to the collaboration software category from the beginning of the pandemic to now. Last month’s collaboration traffic was 4x as much as traffic from exactly a year ago. This correlates directly to buyer intent. In an April survey of over 2,000 members of the TrustRadius community, 15% planned to increase their software spending as a result of COVID-19. Nearly 60% of those businesses planned to purchase collaboration software.

Below we dig deeper into how the collaboration software market has changed over the past year—including the explosive growth caused by COVID-19. We’ll also dive into the leading collaboration products in today’s market and explore how market share has shifted along with buyer behavior on the TrustRadius platform.

Quick Access

A Year in Review

COVID-19 Impact

Most Popular Tools Today

Collaboration Software Reviews

Collaboration on TrustRadius vs. G2

Collaboration Software: A Year in Review

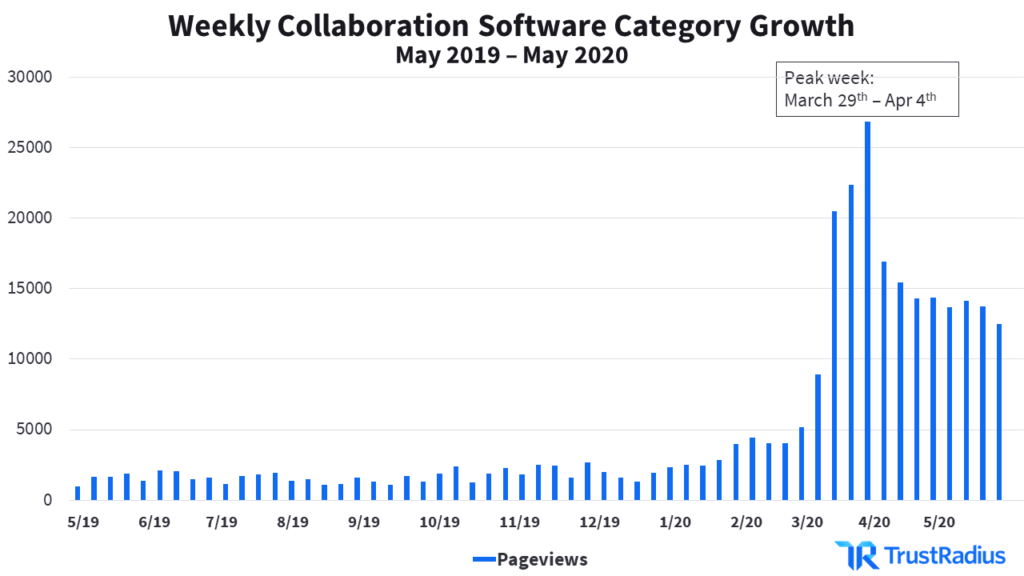

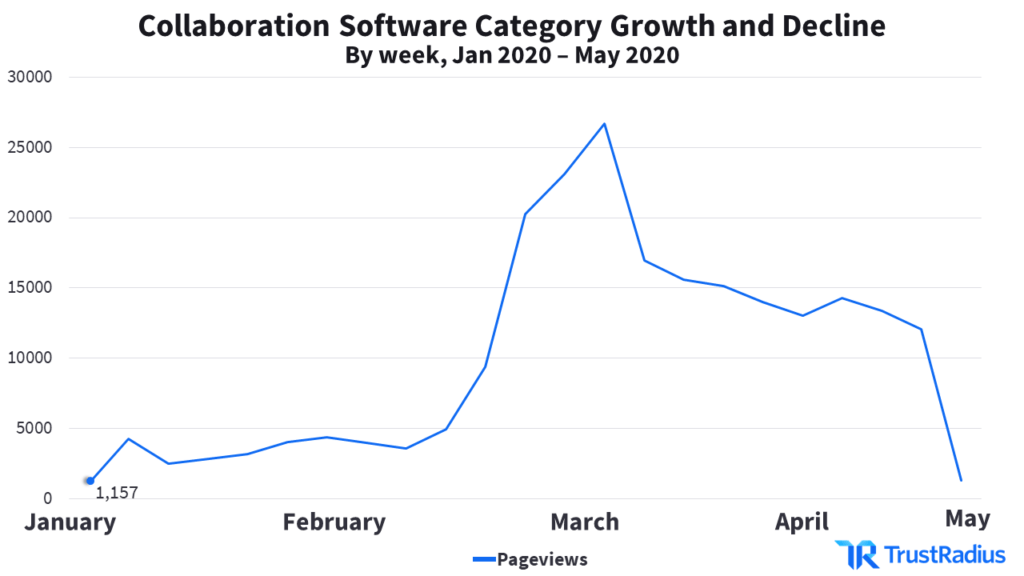

Collaboration software has consistently been a popular category on the TrustRadius platform. 1,178 reviews were published in the category in the past year. Looking at total traffic to the collaboration software category on TrustRadius from May 2019 to May 2020, we saw a significant increase in pageviews at the beginning of March as COVID-19 restrictions kicked in.

Over the past year, the average traffic for the collaboration software category was 1,605 pageviews per week. Weekly collaboration traffic increased to an astonishing 26,642 pageviews per week during the week of March 29th. This is more than 16X the amount of traffic we reported just last year. Other categories where spending was expected to increase (including video conferencing and remote desktop software) followed a similar trend.

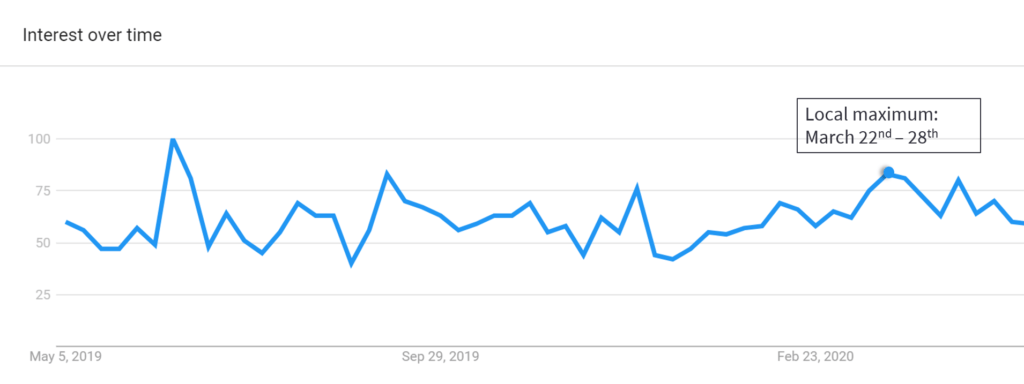

Looking at worldwide Google searches for collaboration software, the highest peak was in June 2019—the month in which a leading platform, Slack, went public. However, this news-based interest didn’t appear to motivate buyers to actually invest in collaboration software tools. Traffic to this category on TrustRadius remained consistent throughout 2019.

However, the collaboration software market did see an increase in true buying intent this year due to COVID-19. Google searches for collaboration software peaked this year between March 22-28. That was one week before peak buyer activity on TrustRadius. Research shows that general interest searches are common during the discovery, or information gathering, phase of the B2B buyer’s journey. Buyers reading reviews and running comparisons on TrustRadius are further along the path to purchase, demonstrating higher intent to buy.

The Impact of COVID-19 on Collaboration Software

When considering the impact of COVID-19 on the software market, one clear example is web conferencing—a category that saw a 1080% increase in traffic on TrustRadius in March. Collaboration software observed a smaller yet significant increase of 670%, which cannot be ignored.

Leading collaboration tools like Slack, Discord, and Microsoft Teams are designed to mimic the interactive nature of physical office spaces with dedicated team channels and more advanced integrations for file sharing, document management, and workflow management. This is a natural category for businesses to invest in during a switch to long-term remote work.

Similar to other categories impacted by COVID-19, collaboration traffic began to wane in April and May. This is to be expected as many organizations have quickly researched and made a purchasing decision within the first two months of COVID-19. Many companies are now in the experiential phase with their newly-purchased collaboration software. Buyers are now users, implementing their tools of choice and monitoring adoption throughout their organizations.

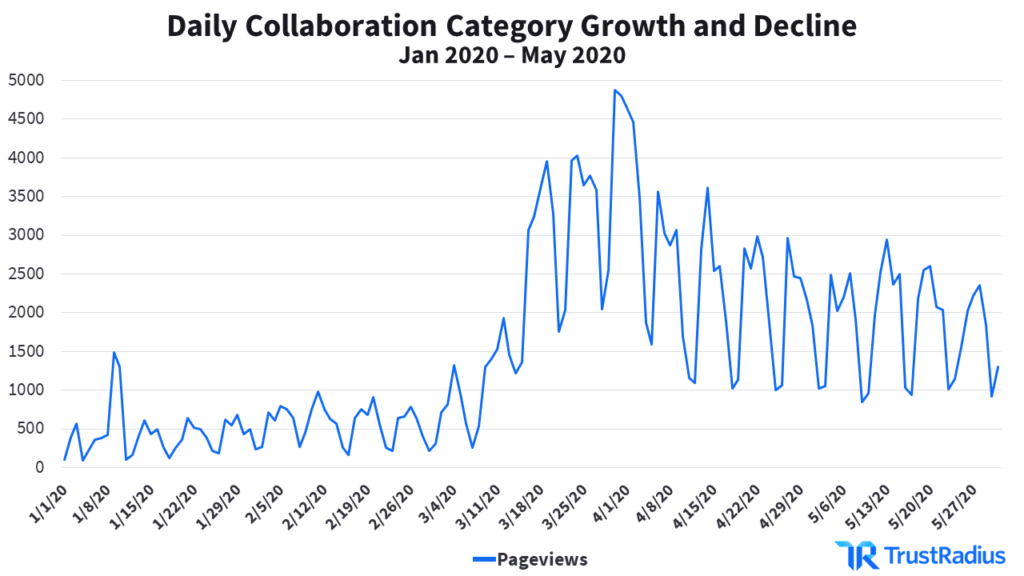

As shown in the daily graph below, collaboration software is most popular on TrustRadius during the weekdays, rather than the weekend. This is in contrast to the video conferencing category, which is researched equally on weekends. Web conferencing supports a wide variety of uses outside of business or education, including personal communication and socializing while social distancing. Collaboration software sits more solidly in the B2B space, and mimics daily trends of other strictly B2B products.

Software Purchasing Trends By Geographic Region

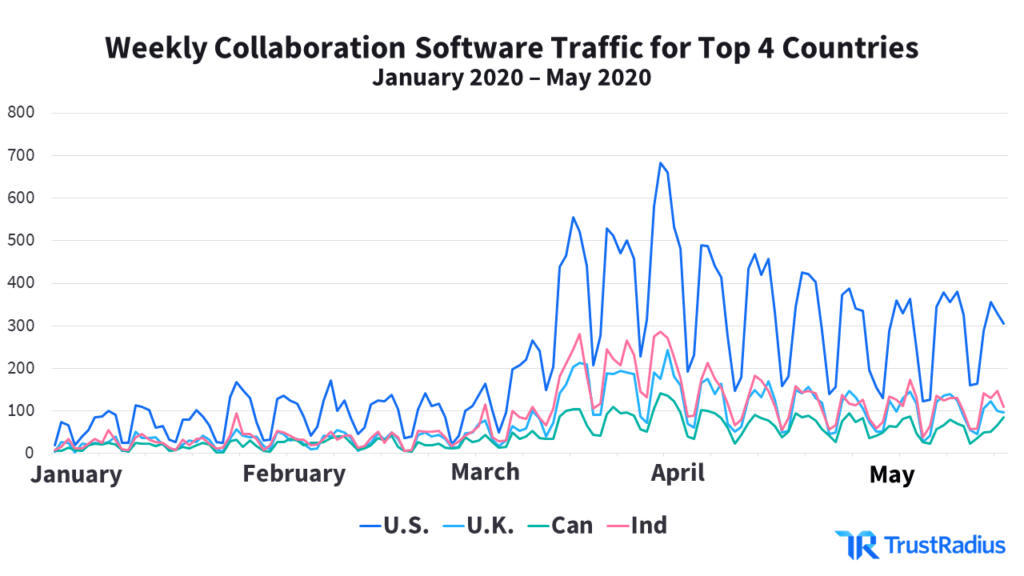

COVID-19 is affecting specific countries and regions differently. Countries that serve as major hubs for the tech industry show the highest amounts of interest and purchasing intent for collaboration software.

The graph below shows TrustRadius collaboration traffic from the top 4 countries (United States, United Kingdom, Canada, and India). The graph shows significantly higher volumes in the United States. This is merely a reflection of relative traffic to TrustRadius. While a large portion of TrustRadius traffic is made up of US-based users, this does not mean that collaboration software is necessarily more popular in the US than other countries around the world. Rather, this graph shows the relative popularity of collaboration software over time within specific countries.

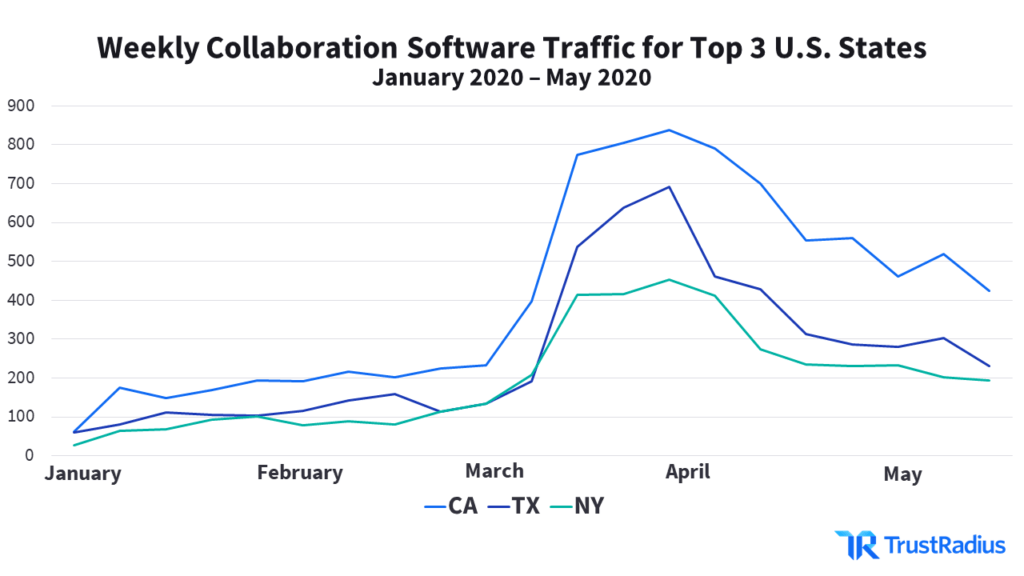

When we take a closer look at the United States, we observe that larger states, and states with a higher number of COVID-19 cases, show more interest in purchasing collaboration software than others.

Similar to worldwide interest, the leading states are also slowing down on their collaboration software research. We are officially in Month 3 of quarantine in the United States and people have been using collaboration software for some time now. Which specific tools are people using, and why?

The Most Popular Collaboration Software Right Now

With Slack being introduced just in 2013, many newer vendors in the online collaboration space have already carved out a name for themselves. There are a handful of clear frontrunners.

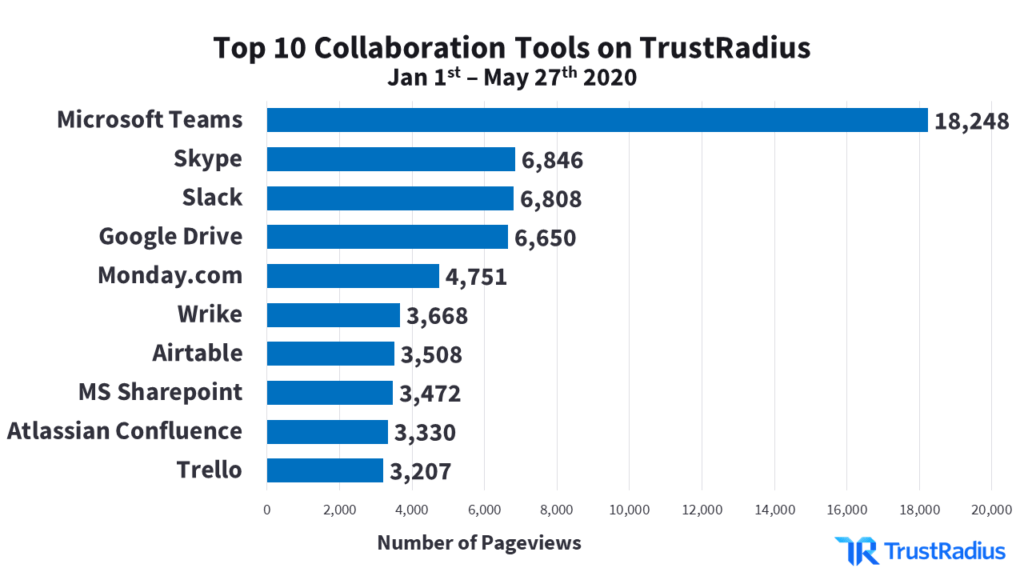

| # | Product | Traffic |

| 1 | Microsoft Teams | 18,248 |

| 2 | Skype | 6,846 |

| 3 | Slack | 6,808 |

| 4 | Google Drive | 6,650 |

| 5 | Monday.com | 4,751 |

| 6 | Wrike | 3,668 |

| 7 | Airtable | 3.508 |

| 8 | MS Sharepoint | 3,472 |

| 9 | Atlassian Confluence | 3,330 |

| 10 | Jabber | 3,168 |

Within the past month, Microsoft Teams alone has compromised 33% of all collaboration software-related traffic on TrustRadius. Alongside Microsoft Teams and Slack on this list, there’s also a strong showing from project management-first solutions like Monday.com, Wrike, Airtable, and Trello. Web and video conferencing contenders like Skype, cloud storage providers like Google Drive, and knowledgebase-style products like MS Sharepoint and Atlassian Confluence also appear on this list. Since there are many ways to collaborate remotely, the collaboration category brings together these different functionalities.

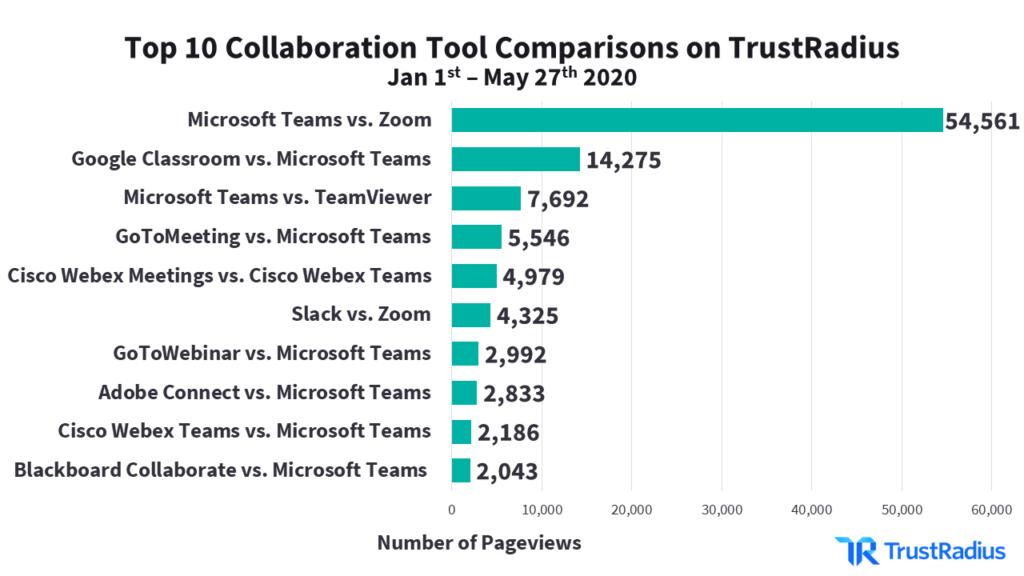

We’ve also observed that the most popular collaboration tools are compared to major players in other categories as well. For example, in May our Microsoft Teams vs. Zoom comparison received 10,414 pageviews alone. Compared to total traffic for comparisons in the collaboration software category, that’s 58%.

| # | Comparison | Traffic |

| 1 | Microsoft Teams vs Zoom | 54,561 |

| 2 | Google Classroom vs. Microsoft Teams | 14,275 |

| 3 | Microsoft Teams vs. Teamviewer | 7,692 |

| 4 | GoToMeeting vs. Microsoft Teams | 5,546 |

| 5 | Cisco Webex Meetings vs. Cisco Webex Teams | 4,979 |

| 6 | Slack vs. Zoom | 4,325 |

| 7 | GoToWebinar vs. Microsoft Teams | 2,992 |

| 8 | Adobe Connect vs. Microsoft Teams | 2,833 |

| 9 | Cisco Webex Teams vs. Microsoft Teams | 2,186 |

| 10 | Blackboard Collaborate vs. Microsoft Teams | 2,043 |

Why Collaboration Software is Thriving

Collaboration software is touted by vendors as being the silver bullet to keeping businesses afloat in uncertain, socially distant times. Collaboration tools keep people connected, but not overwhelmed. They’re designed to keep employees focused and happy. On TrustRadius, reviewers have shed some light on how collaboration software helps them navigate the uncharted waters of 2020.

One reviewer appreciates how Cisco Webex Teams facilitates and replicates casual workplace connections online:

“It’s just brought us closer together. It makes collaboration a real tangible experience and during this COVID-19 crisis this has been a HUGE impact for us in staying connected.”

—Joshua B. | Sr. Systems Administrator | Telecommunications 10,0001+ employees

With Jive, this reviewer has increased engagement between employees, customers, and partners while fostering collaboration throughout their business:

“Internal employees use Jive to share information and collaborate on projects, socialize amongst teams, as well as use it as a platform to learn and help each other. Specific content in Jive is also made publicly available for customers and partners. This helps engagement both internally and externally, and lets the organization grow together as a whole.”

—Patrick L. | CTO (Chief Technical Officer) | Information Technology & Services | 1-10 employees

For this reviewer, Microsoft Teams not only lives up to its name by facilitating teamwork, but acts as an affordable, easy-to-use choice for collaboration software if you’re already embedded in the Microsoft suite of tools:

“Microsoft Teams is the main collaboration tool across our entire organization. A lot of users had received a crash course in its use because of working from home due to the COVID-19 quarantines but many have stated that they are very pleased with the ease of use and ability to connect with remote co-workers. We have even used it to set up a “water cooler” team just to be able to chit chat with other office workers.”

—Michael E. | Network Systems Analyst | Wholesale | 1001-5000 employees

For this user, Slack more than adequately performs as a one-stop-shop for conducting business online and collaborating with teammates:

“We use Slack as our primary inter team communication tool. We have integrated a number of the platforms that easily work within the tool as well as the in-platform call feature. We have created channels where we can communicate product or department specific information. We have a variety of social channels as well where we can share music, choices and lately, photos and ideas on how we are coping with the work from home status.”

—Tom L. | Senior Customer Success Manager | Computer Software | 501-1000 employees

Collaboration Market Growth on TrustRadius vs. G2

As software vendors continue to evaluate the impact of COVID-19 and prepare for an uncertain future, TrustRadius has become the preferred platform for harnessing customer voice in the tech industry.

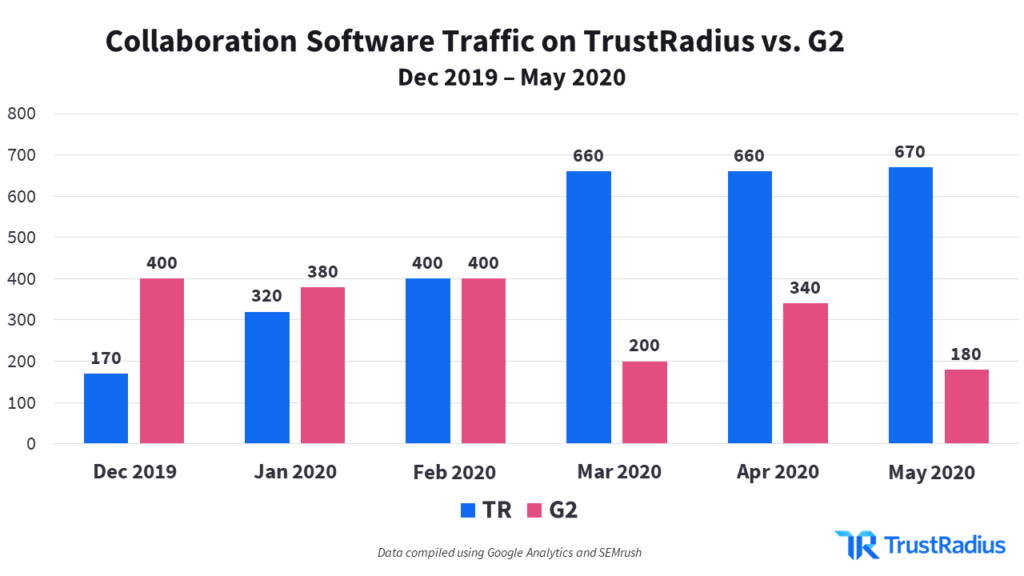

Over the past few months as interest in collaboration software has spiked, TrustRadius traffic for this category has far surpassed that of G2, another software review website. As shown in the graph below featuring third-party data sourced from SEMRush, we received more than 3X traffic to our collaboration software category page compared to G2’s in the month of May alone.

This indicates that TrustRadius has become the leading source for collaboration software reviews during a really exciting time in this industry. Adoption of collaboration tools has surged in response to the pandemic, and vendors with traditionally less market share are making waves amidst increased demand.

Facebook’s entry into the collaboration software category, Workplace, is making major gains in terms of number of paid users, but still trails Microsoft Teams and Slack in terms of overall popularity and adoption. And while other software categories were hit hard by the economic effects of COVID-19, Clubhouse, an up-and-coming collaboration platform, boasted 233% growth at the end of March 2020.

Not only have we seen a steady increase in overall traffic in the collaboration software category this year—we’ve also seen a significant increase in buyer engagement. The average time spent on page for the collaboration software category was 6 minutes 3 seconds in January 2020. This increased by 42% to 14 minutes and 23 seconds in March 2020.

Collaboration software buyers are highly engaged on the TrustRadius platform because of the high-quality content we provide. Across the 3,342 reviews of collaboration software on TrustRadius, the average review contains 328 words. G2 reviews average 130 words in comparison. Detailed answers to key questions, such as use case, pros, cons, and ROI, make TrustRadius the most valuable resource for buyers seeking collaboration software reviews.

In addition to this research, TrustRadius also offers vendors the unique opportunity to see which buyers are considering your products or services right now. We’re currently offering 30 days of free True Intent data to all qualified vendors as one of many ways we’re helping the B2B tech industry work through the challenges of COVID-19. Learn more here.